Hey everyone, I know it’s been a while since we last updated you, but enough time has passed that we now have enough stats to share with you after 2 and a half months of selling Political Animals!

Preface

I’ve talked about the launch of Political Animals before, most of which you can find on our blog. But here’s a little breakdown for the tl:dr folks. Political Animals is a turn-based strategy game where you are an animal candidate trying to win an election and keep your morals intact. We worked on it for two years, half of which was funded by our publisher, Positech Games. Squeaky Wheel is a small Philippine PC game studio that has a bunch of veteran developers in it, and personally the biggest project I ever worked on was Prison Architect, for which I did the art.

The game looked promising in all the events we brought it to, as we even got a staff pick by Eurogamer as one of its EGX games of 2016. We were on the front page of Steam on launch, and had quite a few people streaming our game, most notably folks like Total Biscuit, NorthernLion, Quill18, etc. Given all of that, how did we do?

Did we Break Even?

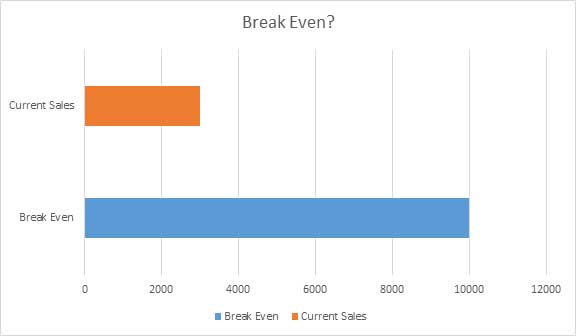

We’ve already mentioned that we’ve had a very poor launch, but it helps to know exactly how badly we did. During the whole of development our internal “break even” number was always 10,000 units x $15, which is the full price of the game. This took into account both development costs and marketing as well as taking into account Steam’s 30% cut of the revenue. So how did we do?

As you can see after two and a half months on sale we’re about 30% of the way to breaking even. Which isn’t so terrible, except this is after the first day sales bump and the Winter Sale. The way things stand we’ll (or rather, our publisher) be very lucky to break even by the end of the year. The only silver lining here for the studio is that none of us put our life savings into the game.

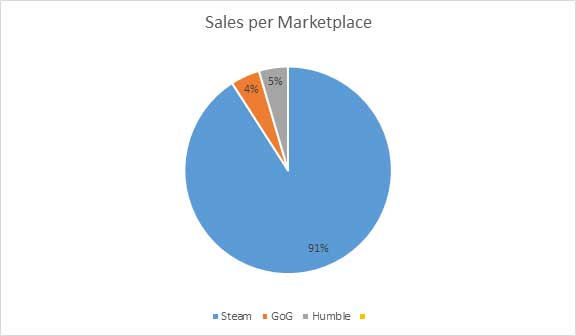

Sales per Marketplace

There aren’t any huge surprises here. Steam is still the dominant digital marketplace when it comes to games. Humble and GoG combined only make up 10% of our total sales so far. I don’t really see this changing in the short term, as Steam really just has so many more subscribers than GoG or Humble combined.

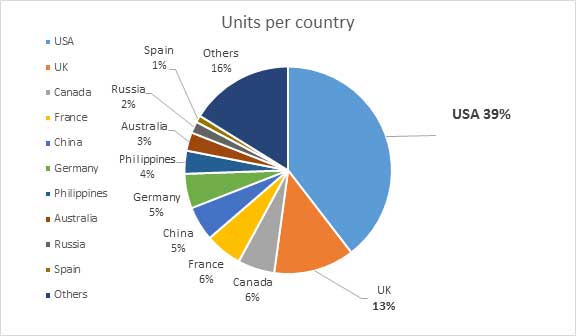

Sales by Country

It gets a little more interesting when we look at units per country. As expected most of our units have been sold in the US. The UK comes in a distant second, which makes sense given Positech is from the UK and has a bit of a following there. We’re not surprised that we quite a few sales in France, Germany, and Canada, as strategy games are usually popular in those countries.

Things start to get interesting when you notice that China is right behind Germany in terms of units sold. When we announced the launch of Political Animals we were contacted by some localizers from indienova offering a translation to Simplified Chinese. To be honest, the Chinese market was a bit of a mystery to us and it wasn’t high priority, but given our poor launch there was little to lose, especially when they offered to localize pro bono. Since Chinese players mostly won’t both bother with a game unless it’s localized or super popular, this guaranteed us a few extra sales. I even took the extra effort to start a Weibo page, though I’m not entirely sure if it really matters.

The process was pretty seamless, but took about a month to iron out the kinks. The additional sales weren’t mind boggling, but we now had numerous people in China downloading and reviewing our game, and most of them seemed happy with it. In the two weeks following our announcement of the localization our Chinese sale shot up by 300% (from a very small number) and during the winter sale Chinese sales were second only to the US. The catch is that Steam’s suggested pricing is 50% off of our regular US price, so every unit sold in China is worth half a unit when it comes to our break even point.

We have localization in the works for Russian and Polish, and we’re hoping they’ll provide a small boost to our sales as well.

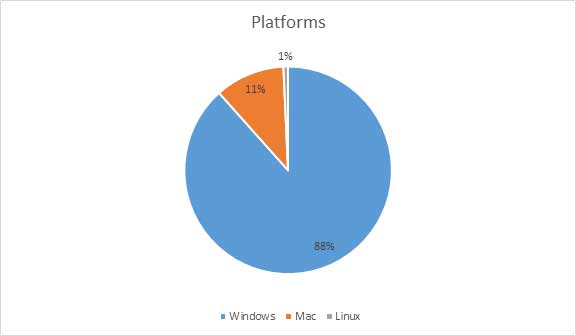

Sales by Platform

Once again no surprises here. Windows makes up the majority of our sales and Mac and Linux combined make up less than 15%. The only thing worth noting here is that the Linux sales were quite disappointing given how much work it took to get it working. We used Unity to make Political Animals, and while porting to Mac was relatively trivial, making the game work on Linux’ multiple distros was a bit of a nightmare for us.

Steam Sales and Wishlist Graph

Lastly, here is the traditional reveal of the Steam sales graph! Our sales peaked at launch, as with most games, and shows a steady decline until a small peak during the Winter Sale. We’d definitely hoped for more of a peak during the winter sales, but given the deluge of games on Steam in 2016 and the fact that we were only 25% off I should have expected that wouldn’t be the case.

As you can see with our wishlist graph, we have quite the gap between our outstanding wishes (players who indicated that they want to play the game) and activations (players who actually bought the game). I suspect what this means is that there are lot of people waiting for the price to go down to an “acceptable” level before they pull the trigger. We’ll find out in one of the future Stream sales as we slowly increase the discount.

What’s Next?

I think we followed a typical pattern of trying to save our game the best we can by pushing out rapid updates, talking to players, etc. At some point you have to concede that the effort involved in this will bring minimal returns, so you have to go back to the drawing board and start a new game. We’re still currently working on a major update to Political Animals that includes local multiplayer, but we’re also hard at work prototyping our next game and thinking about how to release it.

If you have any additional questions about our stats, please feel free to ask and I'll do my best to answer!

Thanks for reading! If you'd like to be updated on the latest Squeaky Wheel news, please sign up for our mailing list, join our Facebook group, or follow us on Twitter!